The property market is expected to start 2021 with a bang, according to experts. Low interest rates, combined with the imminent expiry of both the existing Help to Buy scheme and the Stamp Duty holiday, mean that the market is expected to be busier than ever going into the New Year.

Zoopla has already predicted that this December will be the busiest for the housing market in over 10 years; this is expected to spill into 2021 with an additional 100,000 home sales forecast in the first three months of 2021, as buyers rush to take advantage of the Stamp Duty tax cut ahead of the 31 March 2021 deadline.

Property companies have also seen a distinct shift in buyers’ priorities this year, with many believing that new attitudes will continue to inform the housing market into 2021. Michael El-Kassir, Managing Director of property developer GRE Assets, said, “With the imposed lockdown restrictions meaning people have spent much more time at home this year, we believe this has led to a distinct rise in the number of people seriously considering their next property move.” He continued, “Not only are they spurred on to make the leap from London, they also recognise the importance of having access to green space, whether that is nearby parks, balconies, terraces, and gardens.”

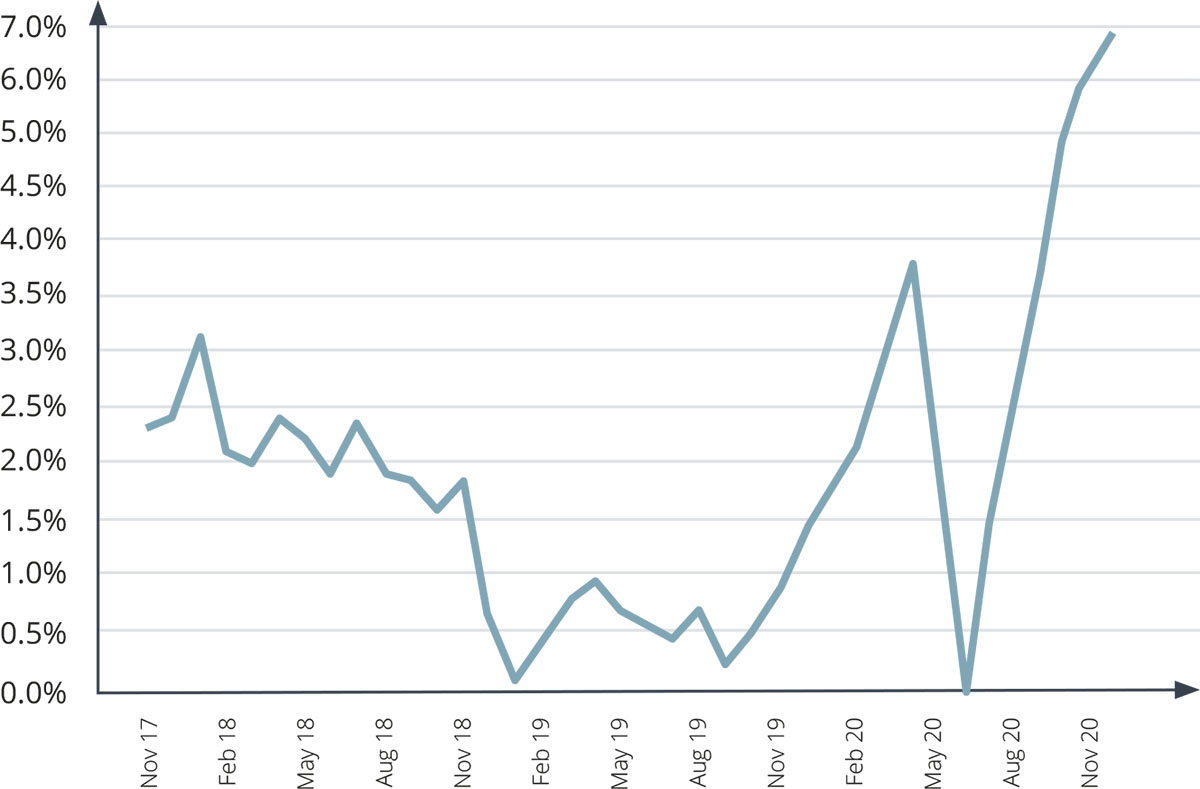

House prices have continued their upward trajectory towards the end of 2020, with annual growth of 6.5% recorded in November – up from 5.8% in October and the highest growth rate since January 2015.

This is according to the latest House Price Index from Nationwide, which also recorded a month-on-month price increase of 0.9% to bring the average house price to £229,721 in November, up from October’s increase of 0.8%.

Robert Gardener, Chief Economist at Nationwide, warned that this rate of growth was unlikely continue, however. He said, “Housing market activity is likely to slow in the coming quarters, perhaps sharply, if the labour market weakens as most analysts expect, especially once the Stamp Duty holiday expires at the end of March.”

A garden was the most desired characteristic for homebuyers 2020, topping the list of Zoopla’s 10 most popular search terms for this year.

The list shows that buyers’ top priorities have been greatly influenced by the pandemic, with ‘detached’, ‘rural’ and ‘secluded’ also ranking highly. Being locked inside their homes for months on end has demonstrably increased property hunters’ desire for green, open space and a quiet, peaceful lifestyle. Also, in line with this theme was ‘balcony’, which placed eighth on the search list.

Meanwhile, ‘annexe’ was in ninth place, perhaps reflecting buyers’ desire to have elderly parents move in with them due to the pandemic.

| “With the imposed lockdown restrictions meaning people have spent much more time at home this year, we believe this has led to a distinct rise in the number of people seriously considering their next property move” |

| Headlines | Nov-20 | Oct-20 |

|---|---|---|

| Monthly Index* | 457.8 | 453.9 |

| Monthly Change* | 0.9% | 0.8% |

| Annual Change | 6.5% | 5.8% |

| Average Price (not seasonally adjusted) |

£229,721 | £227,826 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

“Behavioural shifts as a result of Covid-19 may provide support for housing market activity, while the Stamp Duty holiday will continue to provide a near term boost by bringing purchases forward.”

Robert Gardner, Nationwide’s Chief Economist

Source: Nationwide, House Price Index, October 2020

Gráinne Gilmore, Head of Research at Zoopla commented:

“The pipeline of sales is now nearly 40% bigger than this time last year. The overall number of homes sold in 2020 is set to be 1.1m – just 6% lower than in 2019. It’s remarkable given the outlook and the complete closure of the housing market earlier this year.“

Source: Zoopla December 2020

All details are correct at the time of writing (15 December 2020)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.